Annual salary reconciliation for full-time staff is now due and it is an important activity to ensure employers remain compliant with hospitality labour laws. While the change was introduced by the Fair Work Commission in September 2022, as an annual check the onus is now on employers to complete the audit.

In this post we’ll be discussing what the main rules for annual salaries are, and what is now due.

What is Annualised Reconciliation?

The changes made by the Fair Work Commission on 1st September 2022 affect businesses that employ full-time staff under the Hospitality Industry General Award (HIGA) or the Restaurant Award (RA). These changes aim to ensure that annual salaried employees are not underpaid compared to their award entitlements.

Commonly known as the ‘BOOT’ test, this reconciliation ensures that employees are ‘better-off overall’ on their current arrangements when compared to the equivalent casual rate on the award.

What Are the Rules for Annual Salaries?

To ensure annual salaried employees are not underpaid compared to their award entitlements, the following rules apply:

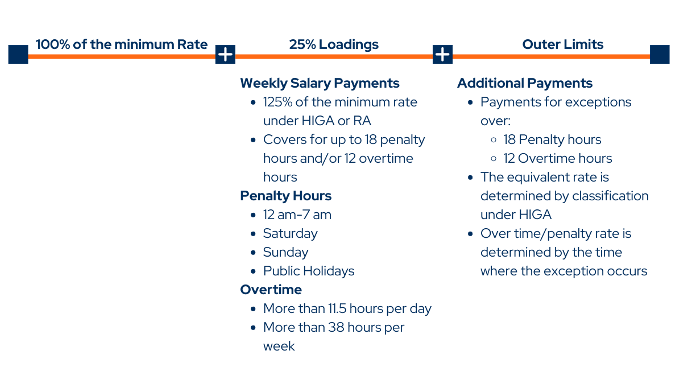

- Minimum annual salary: Employers must pay full-time employees at least 25% more than their minimum weekly rate under the award.

- Outer limits: Employers must pay extra wages to annual salaried employees if they work overtime or penalty hours that exceed their annual salary amount.

- Annual reconciliation: Employers must compare the annual salary paid to each employee with the amount they would have earned under the award, including all the relevant entitlements such as minimum weekly rate, overtime, penalty rates, etc. If the annual salary is less than what the employee would have been paid on the award rate(s), the employer must pay the difference to the employee.

If you want help making sense of salaries in your hospitality business or to utilise any of the tailored technology and expertise we can offer, get in touch here: https://www.quantaco.co/contact-us/