We have been helping clients deliver on their potential, using hospitality-tailored technology to enable better outcomes for years. We do this by increasingly developing our own proprietary technology, whether that’s building customisation into Oracle NetSuite to ensure it’s tailored to the exact needs of hospitality or Salesline where we help operators manage labour costs through near real-time analysis of revenue and labour.

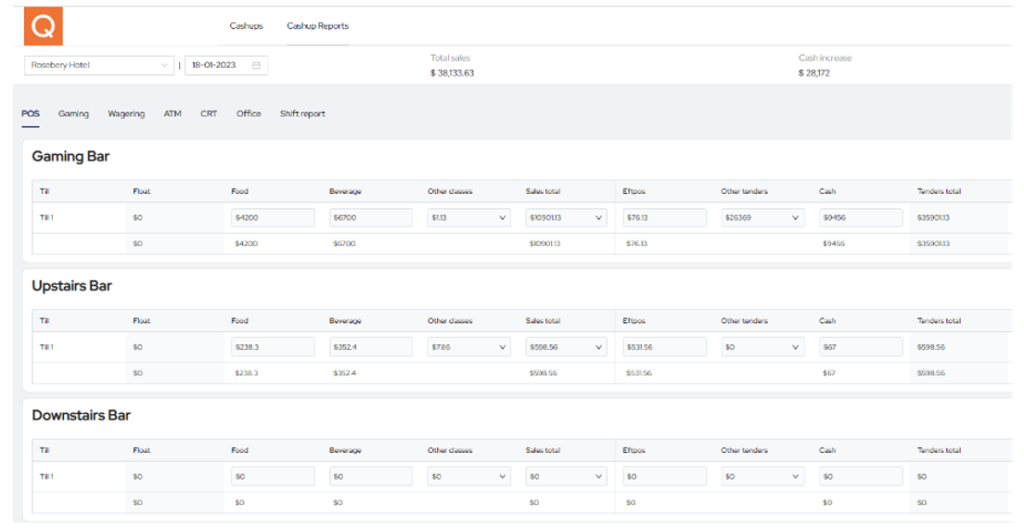

Cashup is our digital platform that allows hospitality venues to enter financial data from across the venue’s trading activities including POS, gaming and wagering. Here’s how and why we built the Cashup platform, with our clients and the hospitality industry in mind.

Solving Challenges Specific to Hospitality

We knew there needed to be a new way to complete the end-of-shift Cashup process. The commonly used spreadsheet was fraught with challenges including it being prone to errors, incorrect information and left them open to manipulation and fraud.

But we also wanted to solve some operational challenges our customers are facing like the ability to capture money as it moved through the venue through things like deposits, petty cash and till sweeps.

With Cashup we had the opportunity to start from scratch and develop a solution that met the needs of our clients. But we knew the only way to ensure that was the case was by including them at every step of the process.

Adopting a Design Thinking Approach

Design thinking is a non-linear, iterative process that teams use to understand users, challenge assumptions, redefine problems and create innovative solutions to prototype and test. And this is the approach we adopted for Cashup’s product development.

Design thinking involves five phases:

- Empathise

- Define

- Ideate

- Prototype

- Test

Stage 1: Empathising

We were lucky to have several of our clients offer to help with articulating some of their pain points as well as capture how they go about the current process across different operations.

Our virtual session ended with a number of pain points all gathered on a virtual wall with sticky notes and allowed us to see the challenges in a wider context.

Stage 2: Defining the Problem

Next, we needed to start to define the actual problem we were going to solve, and it was during this stage that we identified some key themes:

- Security – We needed to create a cloud-based digital environment ensuring a secure and single source of truth.

- Compliance – Logins needed to ensure a secure environment and an auditable trail of activity.

- Useability – A guided workflow would be needed to help those not familiar with completing a Cashup.

- Integrations – With other systems to speed up the task and remove double handling.

- Configurable – To allow for variances across groups to be catered for.

Stage 3: Ideate

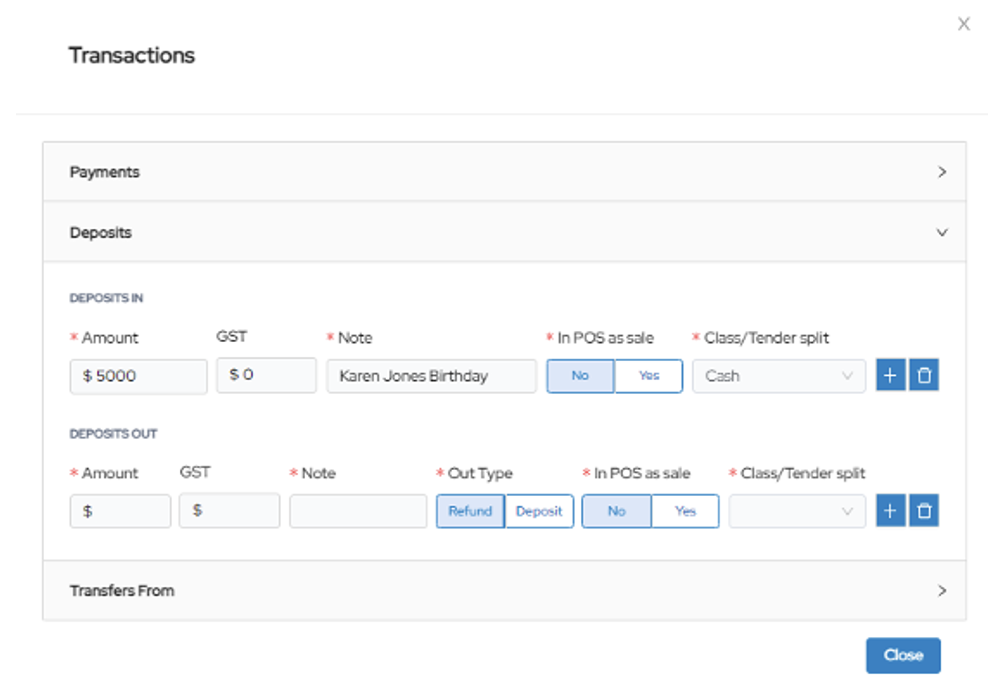

Once we had validated our thinking, we set about solving some of these challenges technically. What we knew from our deep experience in accounting was that the system needed to be more than a ‘moment in time’. This wasn’t about capturing a single number at end of the day, more that it needed to be a ledger system accurately capturing both credits and debits throughout the day.

So, for example, if someone did pay a deposit for a function, that value needed to be accurately captured on the balance sheet as a liability or if someone took money from the till to refill the ATM, we needed to capture that money movement to ensure cash counts were going to be accurate.

Stage 4: Prototype

One of the most critical stages in product development was sharing the first draft designs with users. The prototype needed to be good enough that users feel like they are using the product but built quickly so that changes can be made without too much technical debt being created.

Our volunteer group got hands-on with our first draft and gave some critical feedback which we needed to incorporate to ensure successful adoption of the product. This included:

- People were familiar with the functionality of a spreadsheet, and they didn’t want to deviate too much from being able to tab across cells.

- Where errors had been included, the system should alert you to where the error might be

- People wanted a flexible workflow so they could start anywhere and jump between the different sections without having to complete one section before moving to the next

Stage 5: Testing

Again, we were lucky to have the help of our internal teams and our clients with extensive testing. Usability, functionality, integrations, and bugs are all areas of deep testing to ensure a robust product fit for purpose and able to be easily adopted.

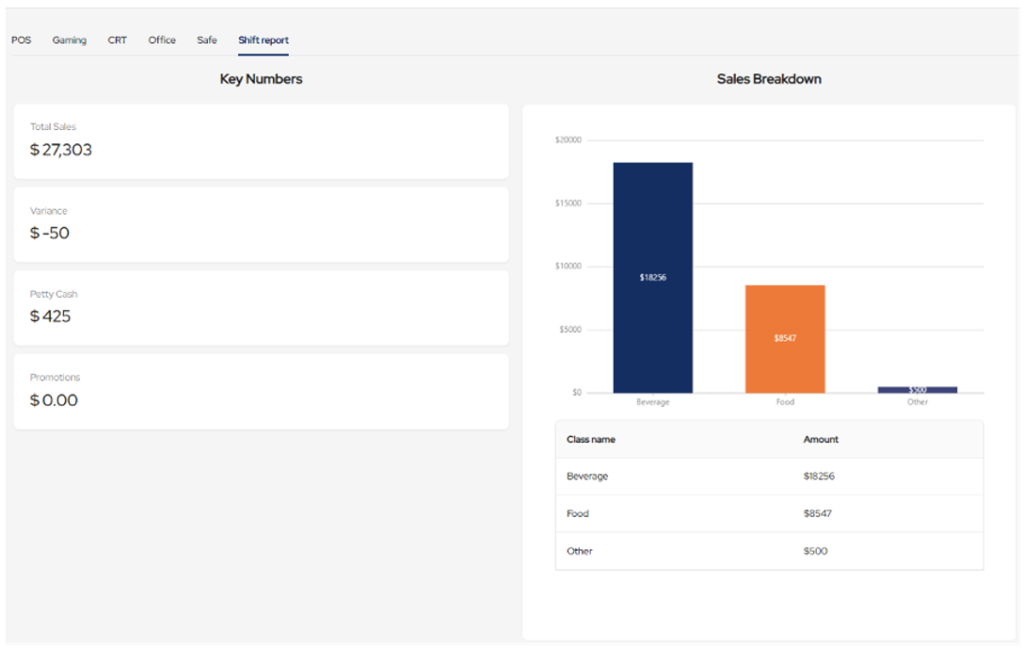

Our internal teams painstakingly replicated several weeks of data across several of our groups to ensure we had not missed anything that our clients might need. And that the output could be seamlessly integrated into our accounting platform to ensure an accurate flow of revenue was being captured.

The result after these 5 stages was the Cashup platform that we know today, and we couldn’t have done it without the work of our incredible team, clients, and volunteers.

To learn more about Cashup and how it’s solving challenges for the hospitality industry, visit here: https://www.quantaco.co/cashup/